Why CFOs and Tax Leaders Are Prioritizing Stability in Their Compliance Partners

February 25, 2025

For many companies, managing tax compliance involves more than merely meeting regulatory requirements—it’s about ensuring stability, reducing risk, and fostering long-term trust. However, frequent changes in service providers, high staff turnover, and inconsistent quality can disrupt operations and create inefficiencies.

Baden Tax Management takes a different approach. By prioritizing long-term relationships and dedicated teams, we provide stability, consistency, and peace of mind, knowing your tax compliance is always in expert hands.

The Disruptive Impact of Vendor Turnover

When companies experience frequent changes in tax service providers, they face operational and financial risks that can create long-term disruptions. Some of the biggest challenges that CFOs and tax leaders encounter with unstable compliance vendors include:

Service interruptions: Transitions between vendors or internal personnel can cause delays, errors, or missed filing deadlines. Inconsistent service can result in avoidable penalties and inefficiencies that affect cash flow.

Loss of institutional knowledge: A revolving door of tax service providers results in the loss of crucial compliance history. New vendors or staff may not fully grasp a company’s tax filing patterns, compliance requirements, or strategic objectives, leading to knowledge gaps that can result in compliance errors.

Increased risk of errors: Disruptions and inconsistent compliance processes increase the likelihood of costly mistakes, miscalculations, and audit exposure. Tax errors can escalate into significant financial liabilities that businesses are forced to absorb.

Retraining is time-consuming: Every time a company switches tax compliance providers, internal teams must dedicate resources to onboarding the new vendor. This diverts tax leaders from strategic planning and other high-priority financial tasks.

These challenges can quickly compound, creating unnecessary burdens for finance teams and leading to missed savings opportunities.

How Baden Provides Consistent, Reliable Service

At Baden Tax Management, we prioritize long-term relationships with our clients. Our team is dedicated to providing consistent, high-quality service year after year. Here’s how we ensure stability for our clients:

Dedicated teams for every client: Clients work with the same experienced professionals, ensuring continuity and a deep understanding of their tax needs.

Low staff turnover and focused expertise: Our team members have extensive experience in tax compliance, and we prioritize maintaining stable teams that stay with clients over time.

Proactive relationship management: Regular check-ins, clear communication, and a focus on long-term partnerships ensure that clients receive consistent, proactive service.

Scalable support for multi-state compliance: Whether managing real or personal property taxes across multiple states, Baden has the capacity and expertise to handle compliance at scale without sacrificing accuracy.

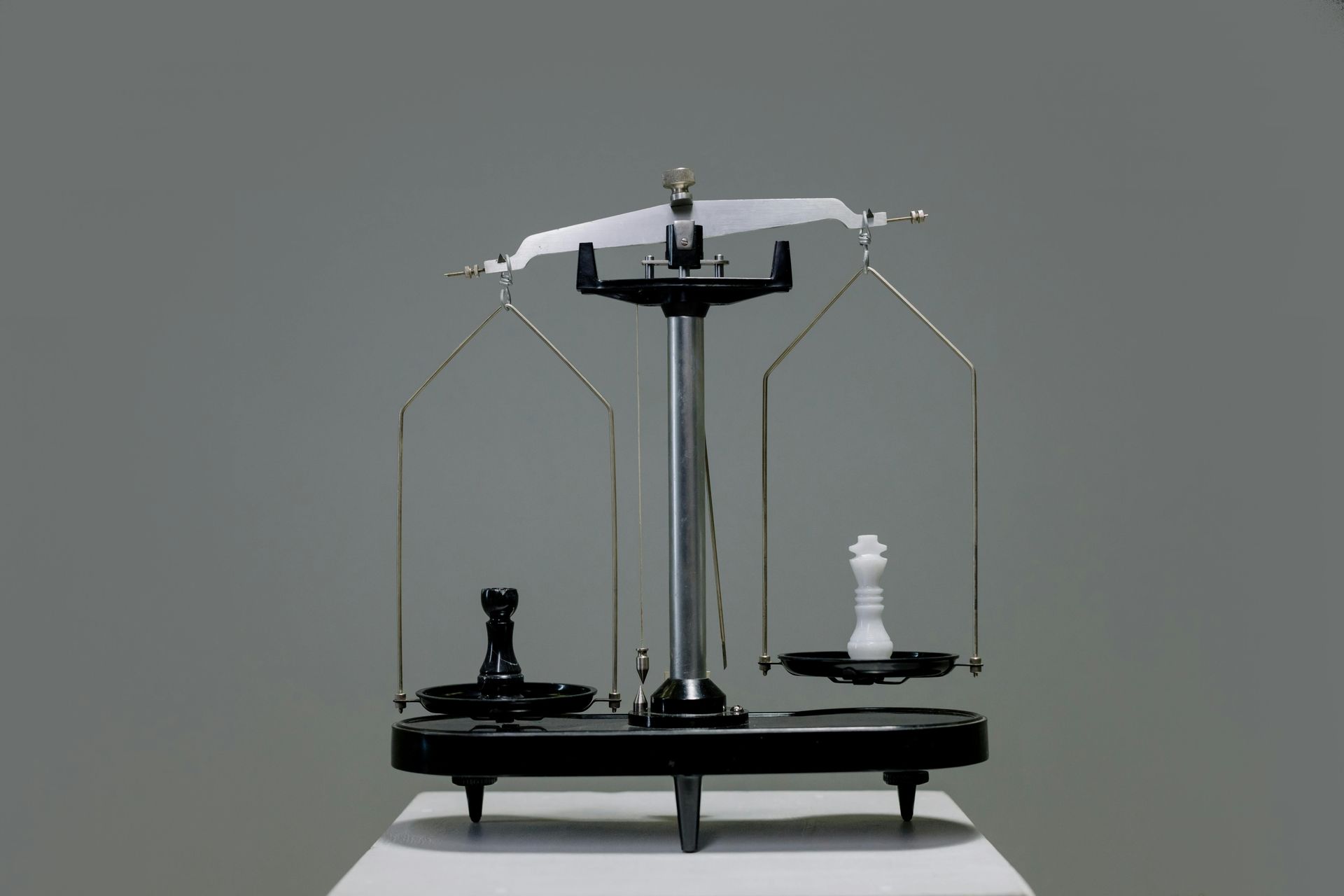

The Strategic Advantage of Stability

For CFOs and tax leaders, having a stable, reliable compliance partner provides several key benefits:

Reduced operational risk: A long-term, dedicated team minimizes compliance risks and ensures smooth filing processes.

Stronger strategic alignment: A stable compliance partner understands a company’s financial and operational goals, helping to optimize tax strategy over time.

Increased efficiency: Without the disruptions of vendor turnover, tax teams can focus on high-value financial planning instead of onboarding new service providers.

Stability Matters in Compliance Partnerships

Consistency and reliability are critical in a complex and ever-changing tax landscape. Baden Tax Management provides stability to CFOs and tax leaders that larger firms and high-turnover providers cannot match.

Let's talk if you’re looking for a compliance partner that delivers consistency, trust, and long-term value.

Contact Baden Tax Management today.